Annual threshold for compulsory VAT registration increases to £90k from £85k

The first rise in the UK VAT registration threshold in over eight years was announced today in the UK Budget. The threshold will rise to £90,000 from the current £85,000. This was set in 2017.

The increase will come into effect from 1 April 2024. In the previous budget, the Chancellor of the UK had committed to hold the threshold until April 2026. However, the inflation spike, and fiscal drag brining many more small businesses into the VAT net has led to today’s announcement.

The rise will take an estimated 28,000 micro-businesses out of the tax net.

Other details included:

- For Northern Ireland, part of the EU VAT union as part of the Windsor Framework Brexit settlement, the registration and deregistration thresholds for EC acquisitions will increase from £85,000 to £90,000.

- The threshold for deregistration will increase from £83,000 to £88,000.

At £90,000, the UK’s VAT registration threshold is higher than any EU Member State and the highest threshold in the Organisation for Economic Cooperation and Development (OECD) alongside Switzerland, and more than double their averages.

UK inflation dragged thousands of businesses into VAT net

As inflation soared above 10% last year, this meant thousands of micro-businesses faced a major tax-induced price rise which they have to consider passing on to their customers.

The UK’s VAT registration threshold (above which persons making taxable supplies are required to register and account for VAT) is currently set at £85,000, although businesses can opt to register voluntarily if their taxable turnover is below this.

The deregistration threshold for taxable supplies, currently £83,000, is set lower than the registration threshold to avoid businesses trading around the threshold level having constantly to register and deregister.

The UK has the highest registration threshold when compared to members of the EU and OECD. It keeps an estimated 3.6 million small businesses out of VAT. The average thresholds in the EU and the Organisation for Economic Co-operation and Development (OECD) countries are, respectively, around £28,000 (€31,000) and c£35,000 ($49,000).

Brexit haunts UK VAT rules

The Treasury said raising the VAT threshold to £90,000 would take 28,000 small businesses across the UK out of paying the tax. The change takes effect from 1 April and is the first increase in seven years.

Under the terms of the Northern Ireland protocol and the Windsor framework negotiated by Rishi Sunak, the UK must respect the EU’s €100,000 VAT threshold when setting VAT rules in Northern Ireland. This is so that businesses in Northern Ireland do not have a tax advantage over EU businesses, ensuring a “level playing field”.

Frozen threshold means doubling of firms holding off sales to avoid registration

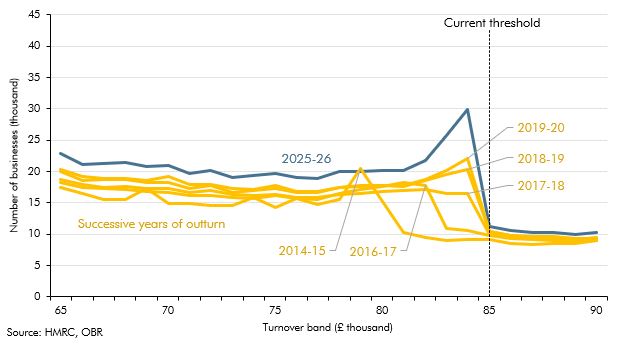

The UK’s Office for Budget Responsibility has concluded that the freeze since 2017 of the VAT registration threshold has caused a long term bunching of businesses just below the £85,000 level. The graph below shows that since 2017-18 when the threshold first reached £85,000, the scale of the distortion below the threshold has been increasing, with 2019-20 the latest year for which outturn data are available. Relative to 2017-18, the number of firms capping their turnover is expected to have almost doubled from 23,000 to 44,000. And relative to a smooth distribution of firms by size, the lost turnover associated with this distortion among these traders is expected to have risen from £110 million to £350 million.

2025 EU VAT registration & Intrastat reporting threshold

| Country | VAT Registration thresholds | Intrastat thresholds | |||||

| Resident | Non-resident | Arrivals | Dispatches | Arrivals Statistical | Dispatches Statistical | ||

| EU SME Scheme | €100,000 | €100,000 EU residents only | |||||

| EU One-Stop Shop | €10,000 | €10,000 EU sellers only | - | - | - | - | |

| Austria | €55,000 | Nil | €1,100,000 | €1,100,000 | €12m | €12m | |

| Belgium | €25,000 | Nil | €1,500,000 | €1,000,000 | €25m | €25m | |

| Bulgaria | BGN 100,000 | Nil | BGN 1.7m | BGN 2.2m | €17m | €36.1m | |

| Croatia | €60,000 | Nil | €450,000 | €300,000 | €450,000 | €300,000 | |

| Cyprus | €15,600 | Nil | €350,000 | €75,000 | €2.7m | €5.8m | |

| Czechia | CZK 2m | Nil | CZK 15m | CZK 15m | CZK 30m | CZK 30m | |

| Denmark | DKK 50,000 | Nil | DKK 22m | DKK 11m | DKK 22m | DKK 11m | |

| Estonia | €40,000 | Nil | Withdrawn | €350,000 | Withdrawn | €350,000 | |

| Finland | €20,000 | Nil | €800,000 | €800,000 | €800,000 | €800,000 | |

| France | Goods €85,000 Services €37,500 | Nil | Discretionary | Discretionary | Discretionary | Discretionary | |

| Germany | €25k prior yr & €100k this yr | Nil | €3m | €1m | €49m | €52m | |

| Greece | Nil | Nil | €150,000 | €90,000 | €150,000 | €90,000 | |

| Hungary | HUF 12m | Nil | HUF 270m | HUF 150m | HUF 5.5bn | HUF 15bn | |

| Ireland | Goods €85,000 Services €42,500 | Nil | €750,000 | €750,000 | €5m | €34m | |

| Italy | €85,000 | Nil | See country guide | See country guide | See country guide | See country guide | |

| Latvia | €50,000 | Nil | €350,000 | €200,000 | €5m | €7m | |

| Lithuania | €55,000 | Nil | €570,000 | €400,000 | €7m | €10m | |

| Luxembourg | €50,000 | Nil | €250,000 | €200,000 | €4m | €8m | |

| Malta | Goods €35,000 Other €30,000 | Nil | €700 | €700 | €700 | €700 | |

| Netherlands | €20,000 | Nil | Discretionary | Discretionary | Discretionary | Discretionary | |

| Poland | PLN 200,000 | Nil | PLN 6.0m | PLN 2.8m | PLN 105m | PLN 158m | |

| Portugal | Nil | Nil | €650,000 | €600,000 | €6.5m | €6.5m | |

| Romania | RON 300,000 | Nil | RON 1m | RON 1m | RON 10m | RON 20m | |

| Slovakia | €62,500 | Nil | €1m | €1m | €1m | €1m | |

| Slovenia | €60,000 | Nil | €240,000 | €270,000 | €4m | €9m | |

| Spain | Nil | Nil | €400,000 | €400,000 | €400,000 | €400,000 | |

| Sweden | SEK 120,000 | Nil | SEK 15m | SEK 4.5m | SEK 15m | SEK 4.5m | |

| Non-EU | |||||||

| Bosnia | BAM 100,000 | Nil | n/a | n/a | n/a | n/a | |

| Iceland | ISK 2m | Nil | n/a | n/a | n/a | n/a | |

| Montenegro | €35,000 | Nil | n/a | n/a | n/a | n/a | |

| Norway | NOK 50,000 | Nil | n/a | n/a | n/a | n/a | |

| Russia | RUB 8m (on application) | Nil | n/a | n/a | n/a | n/a | |

| Switzerland | CHF 100,000 | CHF 100,000 global income | n/a | n/a | n/a | n/a | |

| Turkey | Nil | Nil | n/a | n/a | n/a | n/a | |

| UK (Intrastat Northern Ire only) | £90,000 (Apr 2024) | Nil | £500,000 | £250,000 | £24m | £24m | |